forexeasourcecodes

SOURCE CODE MQL4 Dynamic Gold Scalper

SOURCE CODE MQL4 Dynamic Gold Scalper

Couldn't load pickup availability

Dynamic Gold Scalper: How It Trades

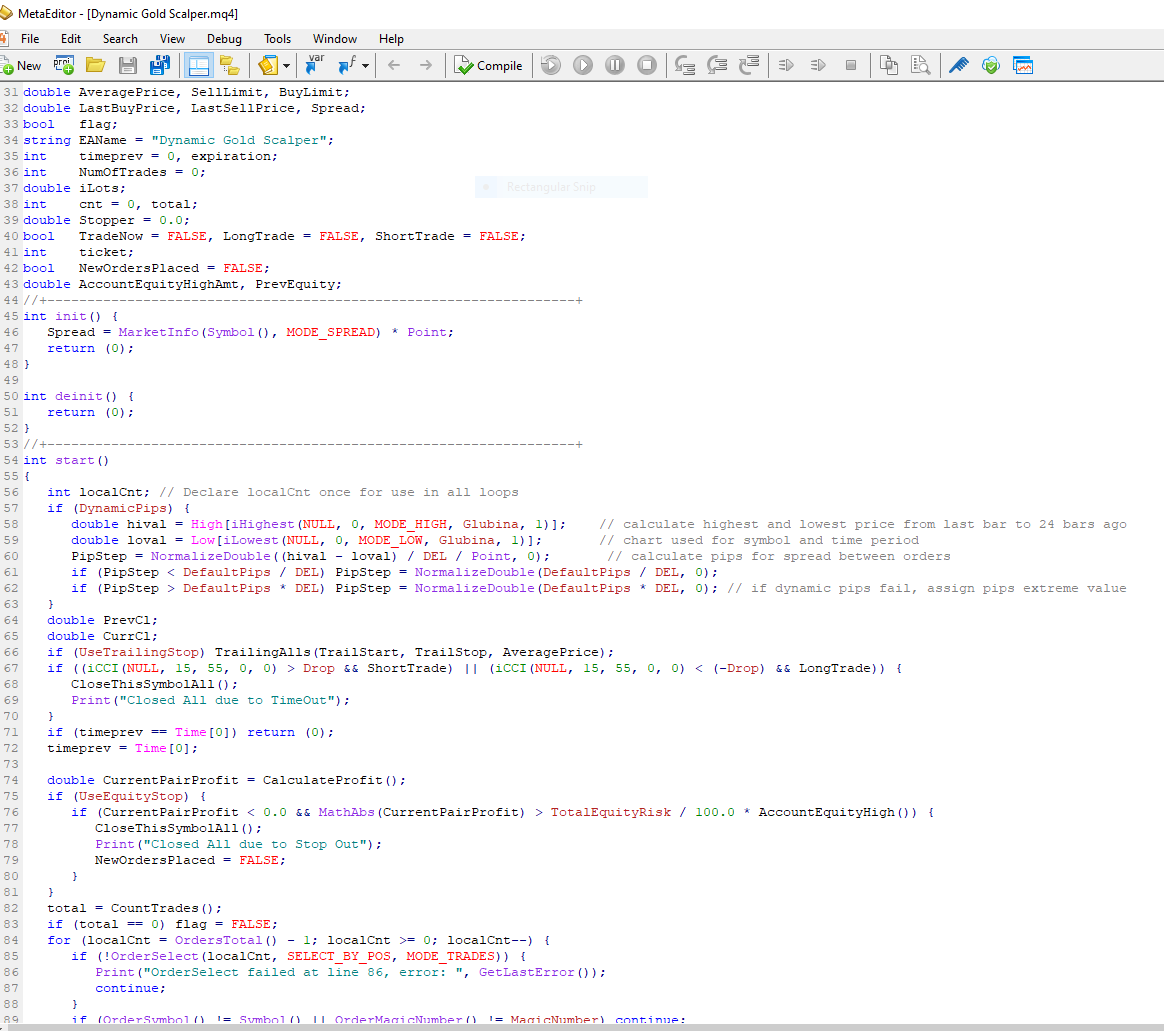

The Dynamic Gold Scalper is a MetaTrader 4 Expert Advisor (EA) designed specifically for trading XAUUSD (Gold), employing a sophisticated grid/martingale strategy to capitalize on short-term price movements. This EA is tailored for traders seeking automated scalping opportunities in the volatile gold market. Below is a detailed explanation of how the EA operates, ideal for showcasing on your website to inform potential users about its functionality and features.

Overview

The Dynamic Gold Scalper EA monitors real-time price movements in XAUUSD, identifies key price levels using a proprietary volatility-based method, and uses technical indicators (RSI and CCI) to filter trade entries. It employs a grid-based approach with dynamic lot sizing to maximize profit potential while managing risk. The EA is designed for MetaTrader 4 and is recommended for testing in a demo environment to ensure optimal performance before live trading.

Trading Logic

The EA’s trading strategy revolves around three core components: identifying key price levels, filtering trades with technical indicators, and managing trades dynamically.

-

Proprietary Price Level Identification:

- The EA uses a unique method to determine significant price levels based on recent market volatility. It calculates a dynamic pip step by analyzing the highest and lowest prices over a 24-bar period (configurable via Glubina). This ensures trades are placed at levels where price action is likely to react, aligning with key support and resistance zones commonly used by traders.

- The pip step is adjusted to stay within reasonable bounds, preventing overly tight or wide trade spacing during low or high volatility periods, ensuring adaptability to market conditions.

-

Technical Indicators for Trade Filtering:

- Momentum (CCI): The EA uses the Commodity Channel Index (CCI) with a 55-period setting to detect overextended market conditions. If CCI exceeds a threshold (default 500 for overbought or -500 for oversold), the EA closes all trades to avoid entering or holding positions in extreme market conditions, enhancing risk management.

- Trend Direction (RSI): The Relative Strength Index (RSI) on a 1-hour timeframe (14-period) filters initial trade entries. The EA opens buy orders when RSI is below 70 (avoiding overbought conditions) and sell orders when RSI is above 30 (avoiding oversold conditions), ensuring trades align with neutral market momentum.

- Volatility Control: By calculating trade spacing based on recent price ranges, the EA indirectly pauses trading during low-volatility periods, as described in its design, to avoid unprofitable conditions.

Trade Entry

The EA employs a grid-based strategy, opening trades at calculated price intervals with increasing lot sizes to recover potential losses. Here’s how it initiates and builds positions:

-

Initial Trade Entry:

- When no trades are open, the EA analyzes the previous and current closing prices to determine market direction. If the previous close is higher than the current close and RSI is above the minimum threshold (30), it opens a sell order. If the previous close is lower and RSI is below the maximum threshold (70), it opens a buy order.

- Initial trades use a starting lot size (default 0.01), ensuring conservative entry into the market.

-

Grid Trading:

- Once a trade is open, the EA places additional buy or sell orders when the price moves a set distance (dynamic pip step) from the last trade’s entry price. This creates a grid of orders, allowing the EA to capitalize on price oscillations.

- The EA maintains a single trade direction at a time (buy or sell), closing opposing trades to focus on the current trend, reducing the risk of conflicting positions.

-

Dynamic Lot Sizing:

- The EA uses a martingale-like approach, doubling lot sizes for each new trade in the grid (configurable via LotExponent = 2). For example, if the starting lot is 0.01, subsequent trades may use 0.02, 0.04, etc., up to a maximum of 10 trades (configurable). This strategy aims to recover losses by increasing position sizes but requires careful risk management due to its aggressive nature.

Trade Management

The EA includes robust trade management features to optimize performance and mitigate risk:

-

Stop Loss and Take Profit:

- Each trade is assigned a stop loss (default 500 points) and take profit (default 20 points) based on the average price of all open trades in the grid. This ensures a balanced risk-reward ratio and protects against significant adverse price movements.

-

Trailing Stop:

- If enabled (via UseTrailingStop), the EA trails the stop loss by 10 points (configurable) once a trade reaches 10 points of profit, locking in gains as the price moves favorably.

-

Equity Protection:

- If enabled (via UseEquityStop), the EA closes all trades if the account’s unrealized losses exceed 20% of the highest recorded equity, safeguarding the account from excessive drawdowns.

-

Timeout Mechanism:

- The EA can close trades after a set period (default 48 hours) or when CCI indicates overextended conditions, preventing prolonged exposure to unfavorable market conditions.

-

Order Cleanup:

- The EA is designed to clear conflicting orders and can be configured to close all trades when removed from the chart, ensuring a clean exit from trading operations.

Customization Options

The Dynamic Gold Scalper offers extensive customization to suit different trading styles and risk tolerances:

- Lot Size: Adjust the starting lot size (Lots = 0.01), lot multiplier (LotExponent = 2), and precision (lotdecimal = 2).

- Price Level Spacing: Configure the lookback period (Glubina = 24), pip step divider (DEL = 3), and default pip step (DefaultPips = 12).

- Indicator Settings: Modify RSI thresholds (RsiMinimum = 30.0, RsiMaximum = 70.0) and CCI overextension level (Drop = 500).

- Risk Management: Set stop loss (Stoploss = 500.0), take profit (TakeProfit = 20.0), maximum trades (MaxTrades = 10), and equity risk (TotalEquityRisk = 20.0).

- Timeouts and Trailing Stops: Enable/disable timeouts (UseTimeOut) and trailing stops (UseTrailingStop), and adjust their parameters.

Why Use Dynamic Gold Scalper?

- Precision Trading: The proprietary price level identification ensures trades are placed at significant market levels, enhancing entry accuracy.

- Adaptive Strategy: Dynamic pip steps and indicator-based filtering adapt to changing market conditions, ideal for the volatile XAUUSD market.

- Risk Management: Features like stop loss, trailing stop, and equity protection help manage the inherent risks of a martingale strategy.

- Customizable: Extensive settings allow traders to tailor the EA to their risk appetite and trading goals.

- Scalping Focus: Designed for short-term trades, the EA targets quick profits in the fast-moving gold market.

Share